Understanding Venture Builders

The ⅓ Founder, ⅓ Scientist, ⅓ Investor DNA That Makes It All Work

At the heart of every successful R&D Venture Studio is a distinctive role: the Venture Builder.

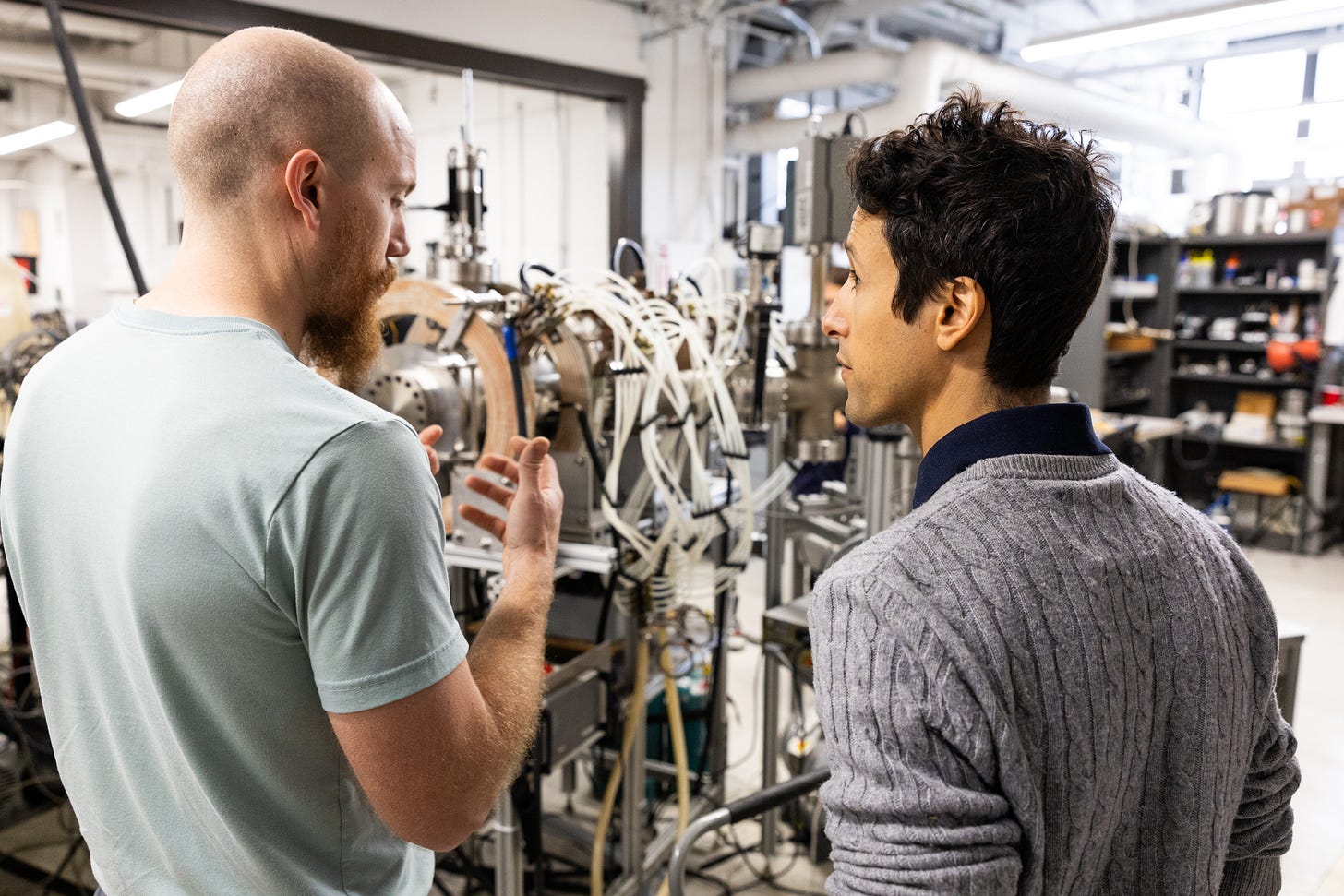

Venture Builders are not mentors, consultants, or entrepreneurs-in-residence in the conventional sense. They are full-time, embedded technical entrepreneurs who lead the charge in discovering, shaping, and launching new ventures from within a research institution.

They are the reason the venture studio model works. And they’re unlike anyone else in your innovation ecosystem.

What Makes a Venture Builder Unique?

If we had to describe the ideal profile, we’d say it’s ⅓ engineer/scientist, ⅓ startup founder, and ⅓ early-stage investor. Here's why each piece matters:

Engineer/Scientist: Venture Builders (VBs) must be able to sit down with a Principle Investigator (PI), understand a complex research breakthrough, and quickly assess its technical potential. They have PhDs in science or engineering. They speak the language of the lab—and can spot what others miss.

Founder: They’ve felt the uncertainty of building something from scratch. VBs are comfortable prototyping, pitching, pivoting, and pushing through ambiguity. They’ve likely been in the trenches of a startup or led early-stage commercialization efforts.

Investor: Like a great early-stage VC, VBs know how to evaluate risk, size markets, test assumptions, and assess founding teams. They know when an idea has legs—and when to walk away.

It’s this combination that makes them powerful. They’re not advising or mentoring ventures. They’re the full stack. They’re creating them.

What Do Venture Builders Actually Do?

In our studio at MIT Proto Ventures, VBs lead venture creation from end to end. That includes:

Embedding in labs, building trust with researchers and scouting promising technologies

Conducting customer discovery to identify market gaps and pressing industry needs

Synthesizing opportunities by matching research capabilities with unmet market demand

Orchestrating early teams, often including researchers, co-founders, and domain experts

De-risking both technology and market, refining ideas through exploration and iteration

Guiding startups toward launch, complete with business models, prototypes, and funder engagement

Our first Venture Builder for Fusion & Clean Energy, David Cohen-Tanugi, partnered with MIT researchers who eventually founded Hyperion Transport Systems, a startup developing electric propulsion systems for satellites based on superconducting magnet research originally developed for fusion energy. We also helped launch Vertical Horizons, which is commercializing advanced power supplies for AI data centers.

Neither of those ventures existed before the VBs got involved. That’s the difference.

Why Institutions Need Venture Builders

Too often, R&D organizations try to “bolt on” innovation by hiring external consultants or relying on existing researchers to lead commercialization. But deep tech venture creation requires full-time, embedded leadership from people who are wired to operate across boundaries.

Without that cross-trained operator in the middle, the venture opportunity either remains hidden—or falls apart in execution.

That’s why we invest so heavily in hiring, training, and empowering Venture Builders. They are not “nice to have.” They are the keystone of the entire model.

Most recently, we hired Andrew Inglis as our first VB in our Geothermal channel, in partnership with Project Innerspace.

A Call to Action

If you’re considering building a venture studio—or investing in one—start by finding your Venture Builders.

Look for people who:

Can talk superconductors and customer segments in the same conversation

Are impatient for impact, but methodical about building

Know how to win trust with researchers and credibility with funders

Want to found something truly original—not just advise from the sidelines

Give them time, space, and support—and you’ll be amazed at what they can unlock.

Our next post in this series is Tech Push Meets Market Pull: The Secret to Launching Deep Tech Ventures That Matter.